BTC Price Prediction: Path to $200K Amid Technical and Macro Crosscurrents

#BTC

- Technical Bottom Forming: Oversold MACD + Bollinger squeeze suggests impending volatility

- Institutional Accumulation: Major funds increasing exposure despite regulatory fog

- Macro Tailwinds: Debt-driven inflation fears enhancing BTC's store-of-value narrative

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Rebound

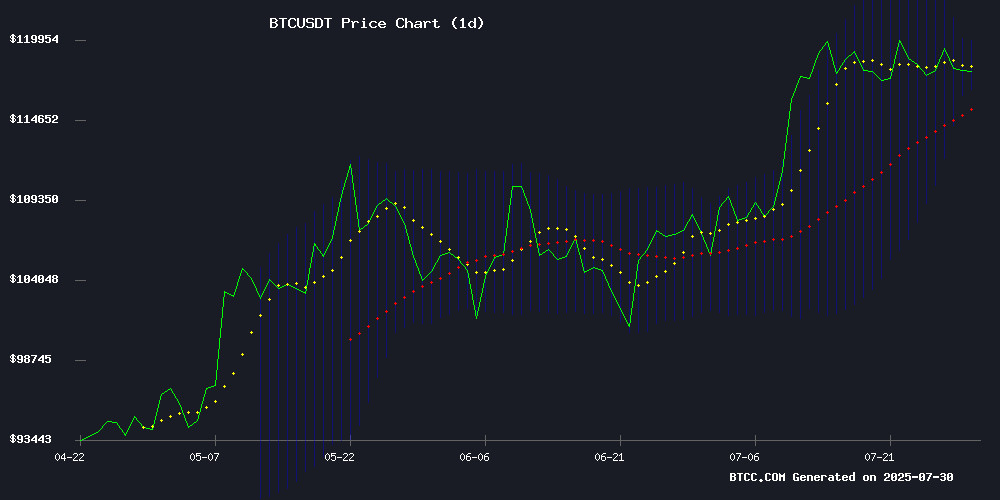

According to BTCC financial analyst John, Bitcoin's current price of $116,224 sits below its 20-day moving average ($118,204), suggesting short-term bearish pressure. However, the MACD histogram shows bullish divergence at +2,098, while price tests the lower Bollinger Band ($116,365) - a traditional reversal zone.John notes.

Mixed Macro Signals Create Bitcoin Standoff

BTCC's John highlights conflicting catalysts:Institutional accumulation (like Twenty One Capital's moves) and Trump's crypto policy ambiguity create asentiment. Miner hedging and whale custody risks remain wildcards.

Factors Influencing BTC’s Price

Fed Holds Rates Steady Amid Rare Dissent, Bitcoin Dips Modestly

The Federal Reserve maintained its benchmark interest rate at 4.25%-4.5% in a widely anticipated move, though the decision saw rare dissent from two governors advocating for a 25 basis point cut. This marks the first dual dissent since 1993, signaling emerging divisions within the central bank.

Bitcoin slipped 0.5% to $117,400 immediately following the announcement, while equity markets pared earlier gains. The crypto reaction remained muted as traders had priced in a 98% probability of unchanged rates, with one notable Polymarket bettor placing a $1.3 million wager on status quo maintenance.

Market attention now shifts to Chair Powell's forthcoming commentary for clues on future policy direction. The statement acknowledged moderating economic growth alongside persistent inflation, setting the stage for continued volatility across risk assets.

Trump Administration Releases Detailed Crypto Policy but Leaves Bitcoin Reserve Plans Unclear

The Trump administration unveiled its most comprehensive digital asset policy to date, presenting a 163-page report that outlines regulatory frameworks for stablecoins, tax reforms, and federal market oversight. Notably absent were further details on the proposed federal Bitcoin reserve, a high-profile initiative first floated in a January executive order.

The report's final section briefly mentions the reserve plan, offering no timeline or substantive updates. Senior officials confirmed the project remains under development but declined to specify whether its progress would be disclosed publicly. This ambiguity has unsettled industry participants who anticipated clearer guidance.

Earlier suggestions that the reserve might incorporate seized assets from enforcement actions had drawn significant attention. The administration's silence on implementation contrasts with its stated commitment to digital innovation, leaving key questions unanswered for market participants.

Bitcoin Investors Hold Firm Amid $1.4 Trillion in Unrealized Gains

Bitcoin holders are demonstrating remarkable conviction, refusing to sell despite record unrealized profits exceeding $1.4 trillion. Glassnode's July 30 report reveals this staggering figure, highlighting a market trend where investors anticipate further price appreciation even after BTC's recent all-time high of $123,000.

The digital asset has since retreated slightly to $118,106, but the holding pattern suggests bullish sentiment remains intact. Such concentrated paper gains create potential for future sell-side pressure if prices continue climbing—a scenario Glassnode analysts warn could trigger significant distribution.

Institutional moves already hint at this dynamic. Galaxy Digital recently facilitated an $9 billion BTC sale for an early holder, signaling possible profit-taking at scale while retail investors hold tight.

Twenty One Capital Boosts Bitcoin Holdings Amid Bullish $150K Price Prediction

Twenty One Capital, a Bitcoin treasury firm backed by Tether and Softbank, announced plans to acquire an additional 5,800 BTC ahead of its public listing via a merger with Cantor Equity Partners. The move will elevate its total holdings to over 43,500 BTC—worth more than $5 billion—solidifying its position as the third-largest corporate Bitcoin holder behind MicroStrategy and Tesla.

CEO Jack Mallers, who also leads Bitcoin payment app Strike, framed the accumulation strategy around Bitcoin's scarcity, calling it "the scarcest thing" in a Bloomberg TV interview. He argued that institutional and sovereign demand will force rapid price discovery, with targets escalating to $150,000 as buyers compete for limited supply. "If you want more bitcoin, you don’t go to the bitcoin factory. You have to go up in price," Mallers said, highlighting Bitcoin's inelastic supply dynamics.

The firm will introduce a "Bitcoin Per Share" metric to provide transparent tracking of holdings, diverging from traditional earnings reports. Tether's continued backing underscores institutional confidence in Bitcoin's long-term valuation trajectory.

163 Pages, No Clarity: U.S. Crypto Report Raises Eyebrows Over Unaddressed Bitcoin Reserve

The White House's 163-page cryptocurrency strategy report has drawn scrutiny for its lack of clarity on the U.S. government's Bitcoin reserves. While the document outlines regulatory priorities and legislative progress, it omits substantive discussion of how the Strategic Bitcoin Reserve will be managed.

Market participants tracking policy developments found little new information in the report. The administration emphasized its regulatory agenda, including stablecoin oversight under the GENIUS Act and broader digital asset legislation moving through Congress. Notably absent was detailed guidance on the government's cryptocurrency holdings.

President Trump's proposal to establish official Bitcoin reserves received only passing mention in the final section of the report. This omission stands in contrast to the document's comprehensive treatment of other crypto policy matters, leaving a critical question unanswered as institutional adoption grows.

A Whale of a Problem: Why Self-Custody Might Sink Bitcoin Giants

The longstanding Bitcoin mantra, "not your keys, not your coins," is facing a reckoning as institutional-scale holders grapple with the impracticalities of self-custody. The recent movement of 80,000 BTC from Satoshi-era wallets—the largest such transfer in Bitcoin's history—has spotlighted the operational risks and liquidity challenges facing whales.

Regulated Bitcoin exchange-traded products (ETPs) are emerging as a compelling alternative. These vehicles, with a seven-year track record in Europe, offer institutional-grade security, tax efficiency, and collateral utility—addressing the slippage and regulatory friction inherent in direct spot holdings.

Ray Dalio Advocates Bitcoin and Gold as Inflation Hedges Amid U.S. Debt Surge

Ray Dalio, founder of Bridgewater Associates, has positioned Bitcoin and gold as critical hedges against inflation and mounting U.S. debt. In a recent podcast, Dalio recommended a 15% portfolio allocation to either asset, citing their resilience in turbulent economic climates. The U.S. national debt has surged past $36.7 trillion, with plans to issue $12 trillion in Treasury bonds—a move intensifying investor anxiety.

Bitcoin's evolution from a decentralized medium of exchange to a premier store of value has attracted institutional and governmental interest. Senator Cynthia Lummis has echoed Dalio's sentiment, advocating Bitcoin as a financial safeguard for low- to middle-income Americans. Despite its potential, Dalio cautioned about Bitcoin's transparency risks and code vulnerabilities, underscoring the need for balanced exposure.

Bitcoin Miner MARA's AI Strategy Faces Scrutiny Amid Halving Preparations

Marathon Digital's unconventional approach to artificial intelligence partnerships is drawing skepticism from analysts. The Bitcoin miner reported record Q2 revenue of $238 million, a 64% year-over-year increase, with net income soaring to $808 million thanks to valuation gains on its BTC holdings.

Compass Point maintains a neutral rating, questioning the viability of MARA's strategy to co-develop AI platforms with energy companies. While competitors pivot toward high-performance computing to offset rising hashrate pressures, Marathon's method appears to be inflating operational costs without demonstrating clear profitability.

The market responded tepidly to these developments, with MARA shares climbing just 3% to $17.11. As the next Bitcoin halving approaches, investors remain cautious about unproven diversification strategies in the mining sector.

Bitcoin Price Nears Rebound as Crypto Fear and Greed Index Wavers

Bitcoin price has been range-bound since July 14, consolidating below its all-time high of $123,200. A bullish pennant formation on the daily chart suggests an impending breakout, while the Crypto Fear and Greed Index holds at 63—firmly in greed territory despite recent altcoin weakness.

Market sentiment mirrors traditional finance, with CNN's Fear and Greed Index at 68. The crypto-specific gauge analyzes five metrics: volatility in BTC and ETH, derivatives activity, altcoin momentum, and social media buzz. Historically, sustained greed phases precede upward price action.

Will BTC Price Hit 200000?

John maintains a cautiously optimistic outlook: "200K remains achievable in 2025, but requires: (1) A weekly close above $125K to confirm trend reversal, (2) Clear institutional adoption signals, and (3) Resolution of miner liquidity concerns post-halving."

| Key Level | Price | Significance |

|---|---|---|

| Support | $116,365 | Lower Bollinger Band |

| Pivot | $118,204 | 20-day MA |

| Target 1 | $125,000 | Psychological resistance |

| Target 2 | $200,000 | Institutional FOMO trigger |